WELCOME TO Primetime Lending

We are passionate abouthelping you achieve yourhomeownership goals

Here at Primetime Lending, our mission is to provide exceptional service and expert guidance to help our clients achieve their dream of homeownership with the absolute lowest rates possible. As a locally owned and operated company based in Sarasota and Miami, we bring over 25 years of combined mortgage experience to the table.

Meet the Team

Get to know the dedicated professionals who are here to guide you through every step of your mortgage journey.

Cory Banks

Broker/Owner – NMLS#737363

phone: +1 (817) 883-5600

e-mail: Cory@LendingPrimetime.com

Cory Banks

Broker/Owner – NMLS#737363

phone: 941-387-4434

e-mail: Cory@LendingPrimetime.com

Cole Brantley

Broker/Owner – NMLS#1905939

phone: 913-579-8812

e-mail: Cole@LendingPrimeTime.com

Cassandra McCarley

Manager/Broker – NMLS#1510233

phone: 813-943-4663

e-mail: Cassandra@LendingPrimetime.com

Tony Fitzgerald

The Fitzgearld First Response Mortgage Group – NMLS#1284924

phone: 941-809-5150

e-mail: Tony@LendingPrimetime.com

Josh Loher

Broker/Realtor – NMLS#1896149

phone: 843-855-5085

e-mail: Josh@LendingPrimetime.com

Stephanie Zent

Broker – NMLS#2623736

phone: 260-920-8712

e-mail: Stephanie@LendingPrimetime.com

Matt Briley

Processor/Broker – NMLS#1800708

phone: 941-518-5893

e-mail: Matt@LendingPrimetime.com

Claudia Caminiti

Broker – NMLS# 676534

phone: 786-250-8812

e-mail: Claudia@lendingprimetime.com

Primetime Lending

Your Mortgage Team

Primetime Lending

Doing business in....

OUR MISSION

We strive to build lasting relationships through exceptional service, integrity, and expertise, ensuring a seamless and supportive lending experience from start to finish.

Step 1 - Get Pre-Approved

Getting pre-approved for a mortgage is the crucial first step in the home buying process. It involves your lender reviewing your financial information to determine how much you can borrow and what interest rate you qualify for. With a pre-approval letter in hand, you’ll show sellers that you’re a serious buyer, and it streamlines the path to securing your dream home.

Step 2 - Find Dream Home

Finding your dream home is the most exciting step in the home buying process. You get to explore different neighborhoods, attend open houses, and envision your future in various properties. With your pre-approval in hand, you can confidently make offers on homes that fit your budget and lifestyle, turning your homeownership dreams into reality.

Step 3 - Let the Magic happen

The lending and closing process is the final chapter of this journey. Once your offer is accepted, we will finalize your mortgage documents, ensuring all financial details are in order. The closing company will perform the necessary due dilligence and communicate with us to coordinate the magic that happens in the background. On closing day you’ll review and sign all necessary documents, pay closing costs, and officially take ownership of your new home.

Here is a short list of the key pieces of information that will be required to get you started in the mortgage process:

- Personal Identification: Valid ID such as a driver’s license or passport.

- Proof of Income: Recent pay stubs, W-2 forms, and possibly tax returns if you’re self-employed.

- Credit History: Authorization for the lender to check your credit report and score.

- Employment Verification: Contact information for your employer to verify your job status.

- Assets and Debts: Bank statements, investment accounts, and information on any outstanding debts.

- Down Payment Information: Proof of funds for your down payment and any closing costs.

Once we review these documents, we can determine how much you can borrow and provide you with a pre-approval letter, setting you up for a smoother home buying process.

These steps provide a clear roadmap for the home buying process, ensuring a smooth journey from gathering documents to closing the deal.

- Getting Pre-Approved for a Mortgage: Pre-approval is the first step in the home buying journey. It provides a clear budget and shows sellers you’re a serious buyer, giving you a competitive edge in the market.

- Finding a Good Realtor: A knowledgeable realtor can make a significant difference. They offer expertise in local markets, negotiate the best deals, and guide you through each step, ensuring a smoother and less stressful experience.

- Conducting a Thorough Home Inspection: A home inspection is crucial to identify potential issues. It can reveal hidden problems like structural defects, plumbing issues, or pest infestations, helping you avoid costly surprises after purchase.

- Understanding Closing Costs: Closing costs typically range from 2% to 5% of the loan amount. These fees cover expenses like appraisals, title insurance, and attorney fees. Knowing about these costs helps you budget more accurately.

- Importance of a Final Walk-Through: The final walk-through ensures the property is in the agreed-upon condition. It’s your last chance to check for any repairs that haven’t been completed or new issues that have arisen before closing the deal.

A good realtor plays a vital role in making your home buying experience successful and less stressful.

Here are five interesting facts about finding a good realtor and their responsibilities as your agent:

- Local Market Expertise: A good realtor has in-depth knowledge of the local market. They understand neighborhood trends, property values, and school districts, helping you make informed decisions about where to buy.

- Skilled Negotiator: Realtors are trained negotiators who work to get you the best deal. They handle offers and counteroffers, striving to secure favorable terms and prices that align with your budget and needs.

- Access to Listings: Realtors have access to comprehensive listing databases, including properties not yet on the public market. This gives you a broader range of options and can help you find your dream home faster.

- Managing Paperwork: The home buying process involves a lot of paperwork. Your realtor manages all necessary documents, ensures compliance with legal requirements, and helps you understand the terms and conditions.

- Guidance and Support: A good realtor provides ongoing support throughout the buying process. They assist with home inspections, appraisals, and closing procedures, ensuring you feel confident and informed at every step.

These costs give a comprehensive overview of the financial aspects to consider when purchasing a home, helping you prepare and budget accordingly.

Don’t worry about navigating these costs alone—give us a call, and we’ll walk you through each step to make the home buying process as smooth and stress-free as possible.

- Down Payment: An upfront payment that is a percentage of the home’s purchase price, typically ranging from 3% to 20%.

- Closing Costs: Fees paid at the closing of a real estate transaction, usually between 2% and 5% of the loan amount. This includes appraisal fees, title insurance, attorney fees, and more.

- Home Inspection Fee: The cost for a professional inspection of the property to identify any potential issues, usually paid by the buyer.

- Appraisal Fee: A fee for an independent appraisal of the property’s value, required by the lender to ensure the loan amount is appropriate.

- Property Taxes: Taxes paid to the local government based on the property’s assessed value, often prorated and included in closing costs.

- Homeowners Insurance: Insurance that covers potential damages to the home, required by lenders, and typically paid annually or as part of the monthly mortgage payment.

- Private Mortgage Insurance (PMI): Insurance required if your down payment is less than 20% of the home’s value, protecting the lender in case of default.

- Title Insurance: Insurance that protects against potential legal issues with the property’s title, ensuring the buyer has clear ownership.

- Escrow Fees: Fees for the service of holding funds and documents until the transaction is complete, ensuring all conditions are met.

- Recording Fees: Fees paid to the local government to record the new property ownership and any related documents.

- HOA Fees: If the property is in a community with a homeowners association, there may be monthly or annual dues for maintenance and amenities.

- Moving Costs: Expenses for moving your belongings to the new home, which can include hiring movers, renting a truck, and packing supplies.

These points outline the key steps and what you can expect on closing day, helping ensure you are prepared and informed throughout the process.

- Final Walk-Through: A last chance to inspect the property to ensure it’s in the agreed-upon condition and that any requested repairs have been completed.

- Signing Documents: You’ll sign various legal documents, including the mortgage agreement, deed, and closing disclosure, outlining the terms and costs of your loan.

- Paying Closing Costs: Be prepared to pay closing costs, which may include fees for the loan, appraisal, title insurance, and escrow. These can be paid via a cashier’s check or wire transfer.

- Receiving the Keys: Once all documents are signed and funds are transferred, you’ll receive the keys to your new home, officially making you the owner.

- Reviewing Settlement Statement: The settlement statement (HUD-1 or Closing Disclosure) itemizes all the credits and debits in the transaction. Review it carefully to ensure accuracy.

- Title Transfer: The title company will transfer ownership of the property to you, recording the deed with the appropriate government office.

- Meeting with Closing Agent: You’ll meet with a closing agent, who will guide you through the final paperwork and ensure everything is completed correctly.

- Lender’s Funding Approval: The lender will provide final approval and release the loan funds to the seller, completing the financial part of the transaction.

- Receiving Documents: After closing, you’ll receive copies of all signed documents, including the deed and mortgage agreement, for your records.

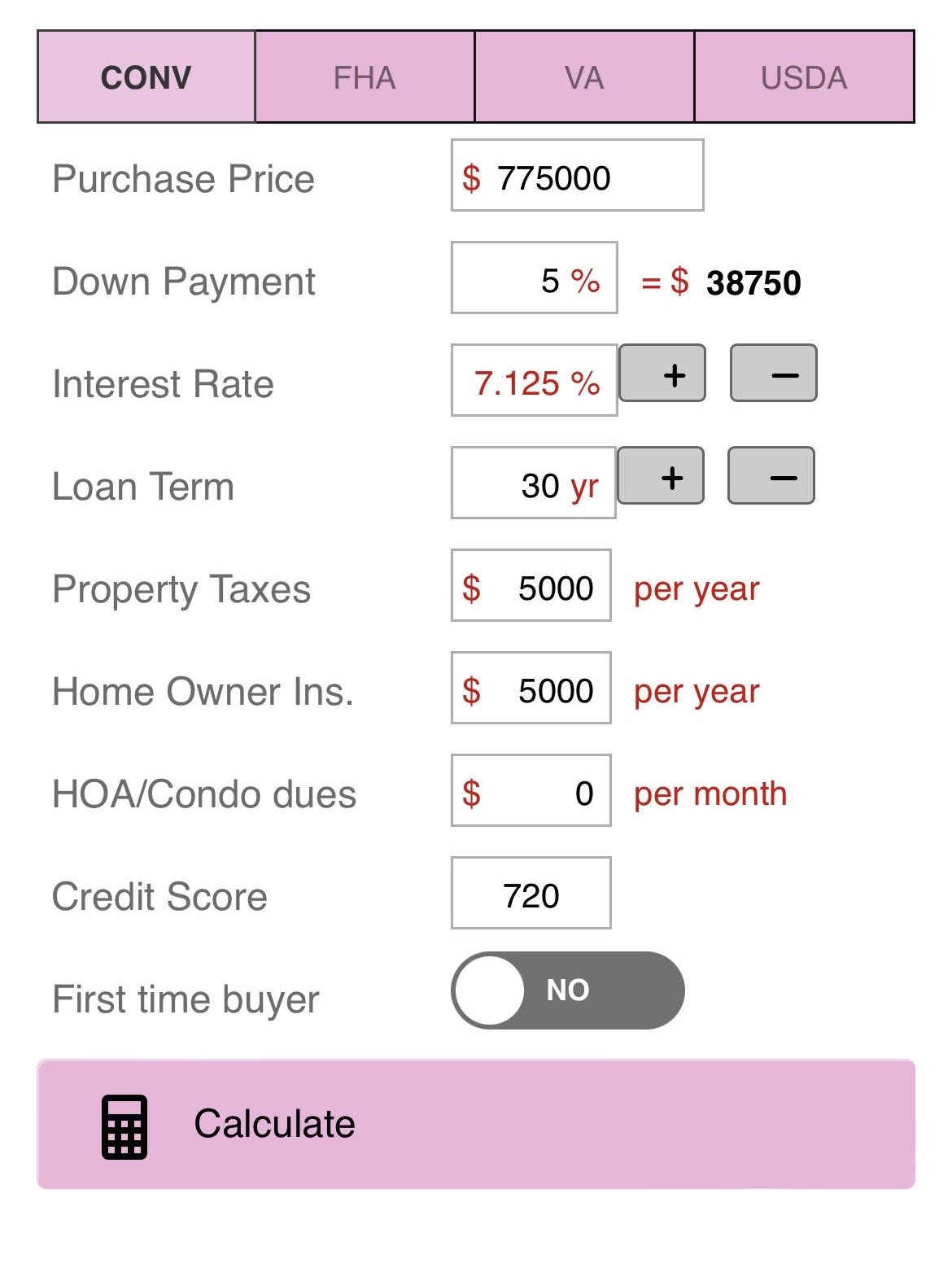

Calculate your payment using our Mortgage Calculator.